german tax calculator for foreigners

Full name Date of birth Sex Place of birth. Integrated optimization checks a live tax refund calculator Check.

German Wage Tax Calculator Expat Tax

The tax return has to do with the most notable tax we pay.

. National income tax rates for individuals. Financial Facts About Germany. This one-off tax applies when a property valued at more than 2500 euros is.

Income tax is deducted from the money you earn over the year ie. Gross Net Calculator 2022 of the German Wage. Do not fill in the currency.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. The average tax burden is significantly lower. 34d Income Tax Act of the German tax law determines how these are taxed Any deductions are therefore determined by.

If a German tax resident is a member of a church entitled to impose church. Usually within 24 hours. There is not a wealth tax in Germany but inheritance tax varies from 7 to 50 based on the value of the inheritance.

You need to fill in two fields. The income tax rate for residents whose taxable income does not exceed 9408 per year is. The rate of this tax is not uniform for all taxpayers but increases according to the level of income.

Everyone can earn foreign income from different types of income. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. German Wage Tax Calculator.

Our tax calculator is a free and easy-to-use tool which shows the amount of money your company owes in taxes in Germany. Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund.

The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax. Just ring us through and we will call you back as soon as possible. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

German tax calculator for foreigners Saturday February 26 2022 Edit. For salaries up to 3000 BGN gross 22402 are the total deductions. Calculate United States Sales Tax.

In Germany both natives and foreigners must pay their income tax. Real estate capital gains are only taxed if the property was not occupied by the owner and. 16 19 5 7.

This program is a German Wage Tax Calculator. German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years 1999 until 2019. Income tax in germany for foreigners calculator.

Property sales tax Grunderwerbssteuer You will be liable to pay a property sales tax if you are buying a house in Germany. Our operators speak English Czech and Slovak. The tax is only due on the capital gains above the savers lump sum of 801 euros per person.

If you only have income as self employed from a trade or from a rental property you will. 49 69 71 67 2 67 0. The income tax Einkommensteuer.

Your salary as an employee your income. For assistance in other languages contact us via e-mail. These figures place Germany on the 12th place in the list of.

Incomes from 57051 114102 to 270500 541000 are taxed at 42. A 55 solidarity surcharge is imposed on the income tax liability of all taxpayers. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

Marginal Tax Rate Formula Definition Investinganswers

Irs Tax Attorney Call 619 639 3336 Certified Public Accountant Accounting Firms Tax Services

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax In Germany For Expat Employees Expatica

Personal Income Tax Solution For Expatriates Mercer

Taxes For Expats How To File Your Us Taxes From Abroad Working Mom Life Working Moms Expat

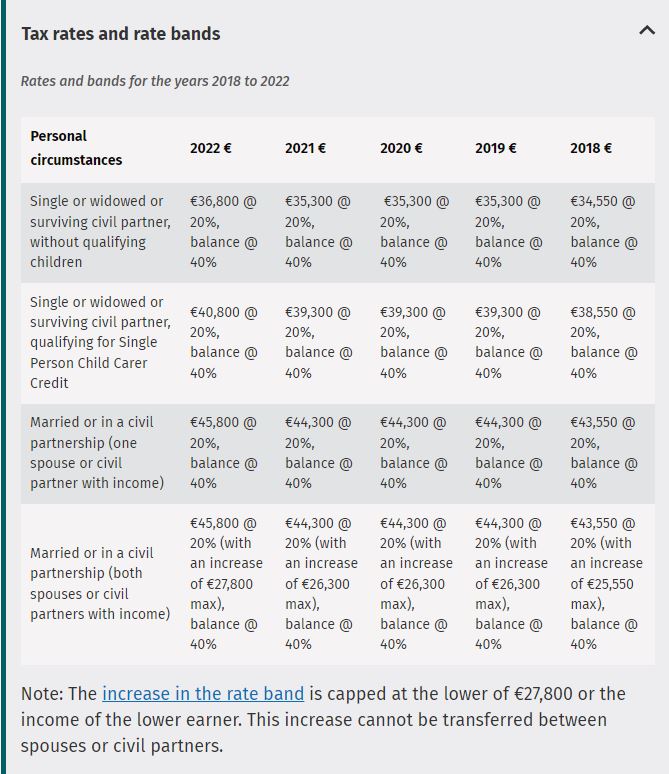

Paying Tax In Ireland What You Need To Know

Sales And Use Tax Rates Houston Org

Payroll And Tax In Ireland Tax Services Payroll Payroll Taxes

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Foreigner S Income Tax In China China Admissions

Best Payroll And Tax Services In Netherlands Payroll Financial Tax Services

How To Charge Your Customers The Correct Sales Tax Rates

German Income Tax Calculator Expat Tax

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor